User Guide#

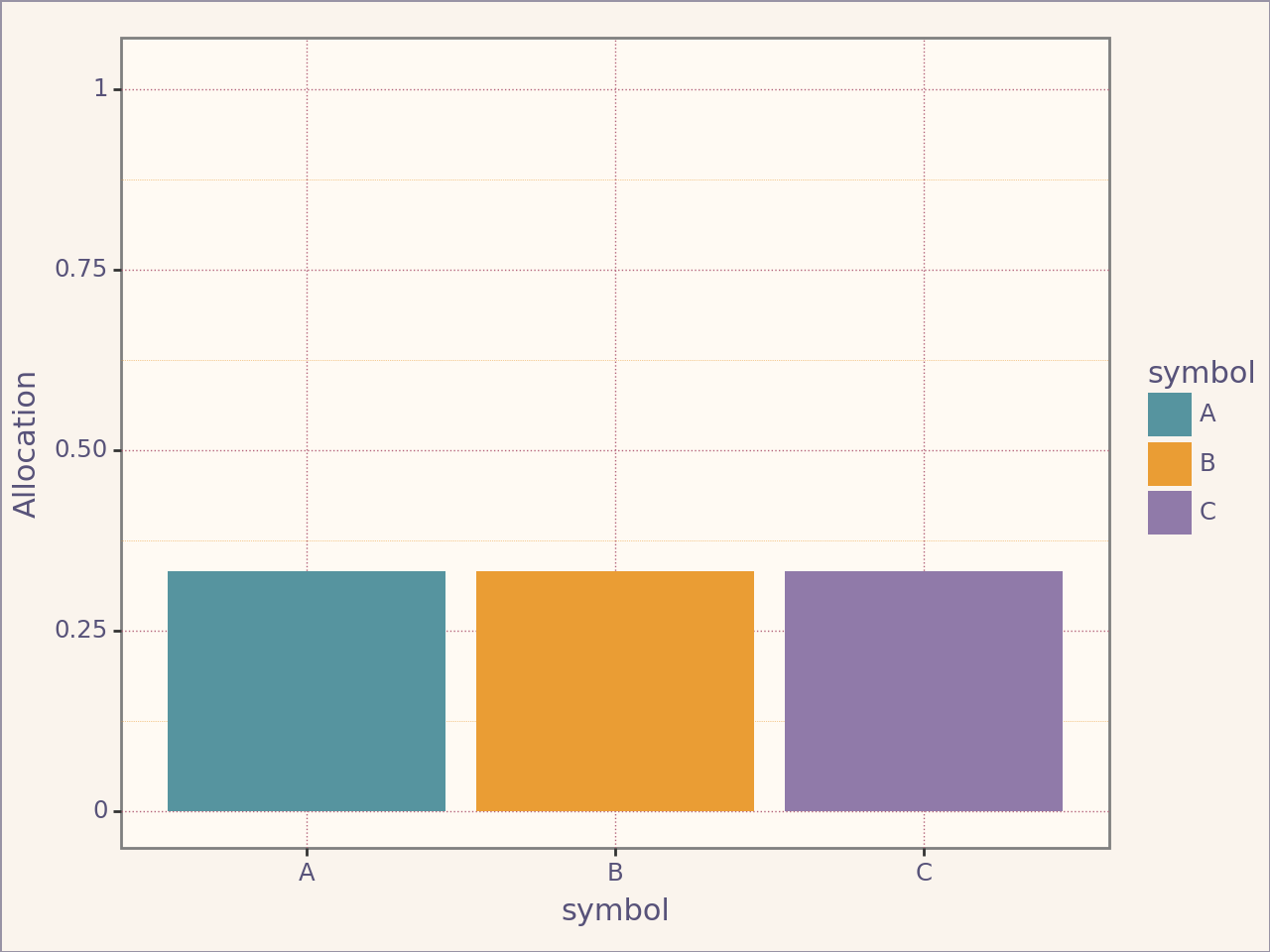

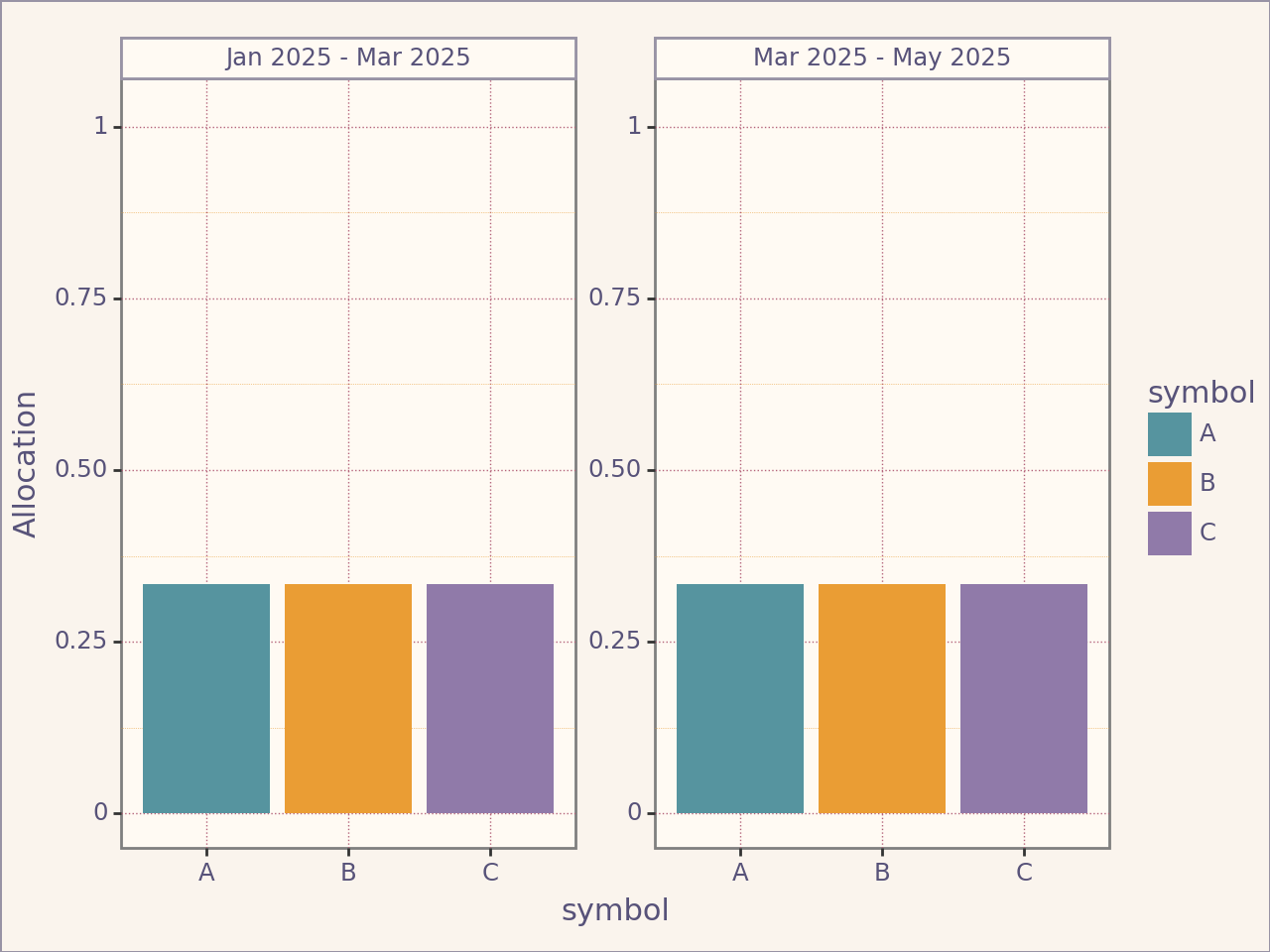

An investment plan covers a time period. It has an associated portfolio. A portfolio includes a set of assets and their associated weights.

Let’s define our plan. We are interested in knowing what we would have earned if we invested equal weights in companies A, B and C. Starting on January up to today (2025-05-02).

Defining a Portfolio#

from portfolio_plan import Assets, Weights, Asset, Portfolio, Frequency

from portfolio_plan.resource import File

from portfolio_plan.data import example_prices_path

portfolio = Portfolio(

assets=Assets(

[Asset("A"), Asset("B"), Asset("C")],

resource=File(path=example_prices_path(), frequency=Frequency.BDAILY),

),

name="Portfolio",

weights=Weights(), # No parameter means equal weights across assets

)

Defining a Plan#

from portfolio_plan import Plan

from datetime import datetime

plan1 = Plan(

portfolio=portfolio,

start_date=datetime.strptime("2025-01-30", "%Y-%m-%d"),

end_date=datetime.strptime("2025-03-01", "%Y-%m-%d"),

)

plan1

------------------------------------------------------------

| Plan for period 2025-01-30 00:00:00, 2025-03-01 00:00:00 |

------------------------------------------------------------

| A |

------------------------------------------------------------

| B |

------------------------------------------------------------

| C |

------------------------------------------------------------

Returns#

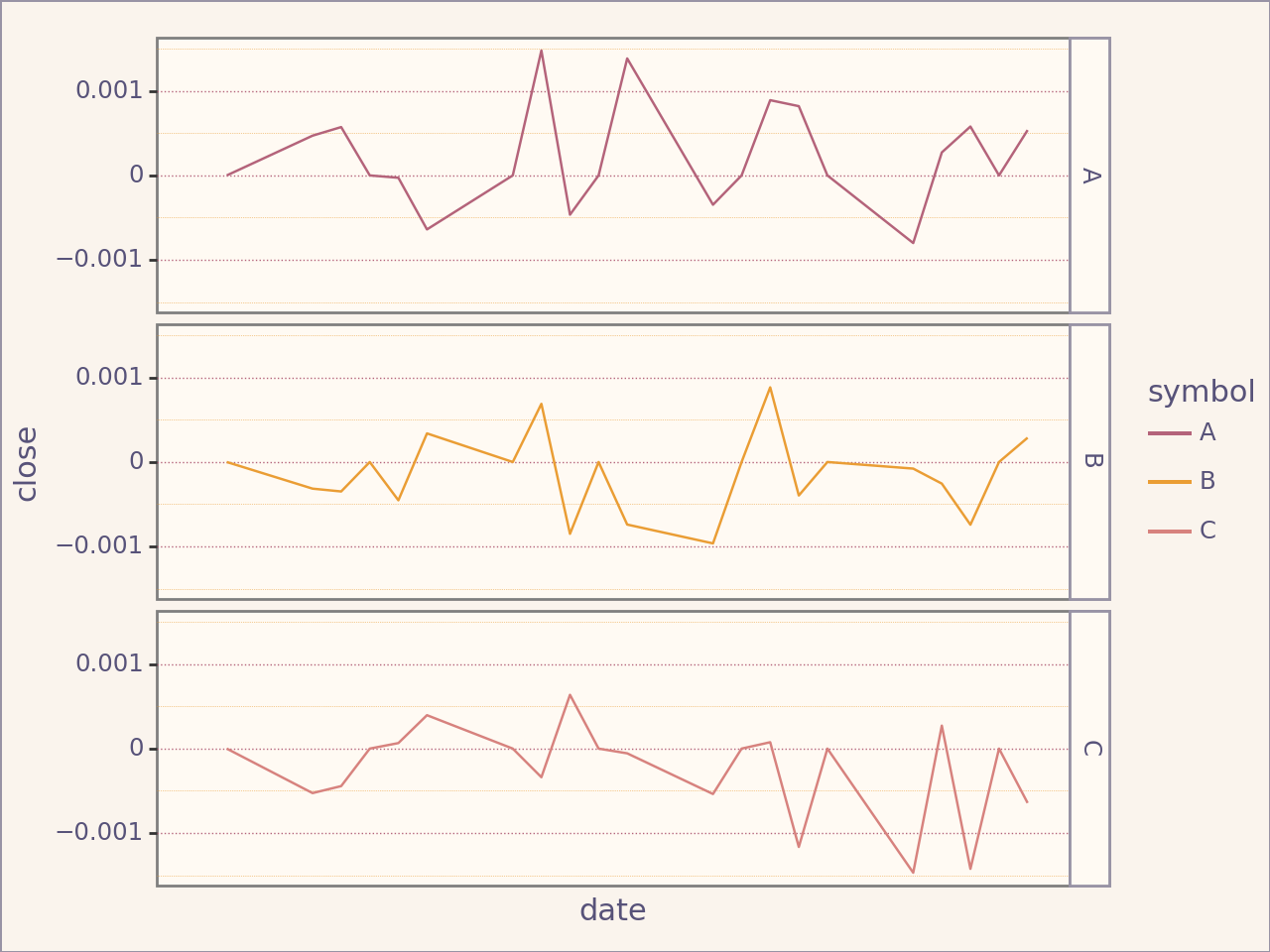

Individual Returns#

returns = plan1.returns(portfolio.name) # Returns object

returns

-----------------------------------------------------------------

| Returns for period 2025-01-30 00:00:00 to 2025-02-28 00:00:00 |

-----------------------------------------------------------------

| A |

-----------------------------------------------------------------

| B |

-----------------------------------------------------------------

| C |

-----------------------------------------------------------------

If we wish to plot the returns:

returns.plot_close()

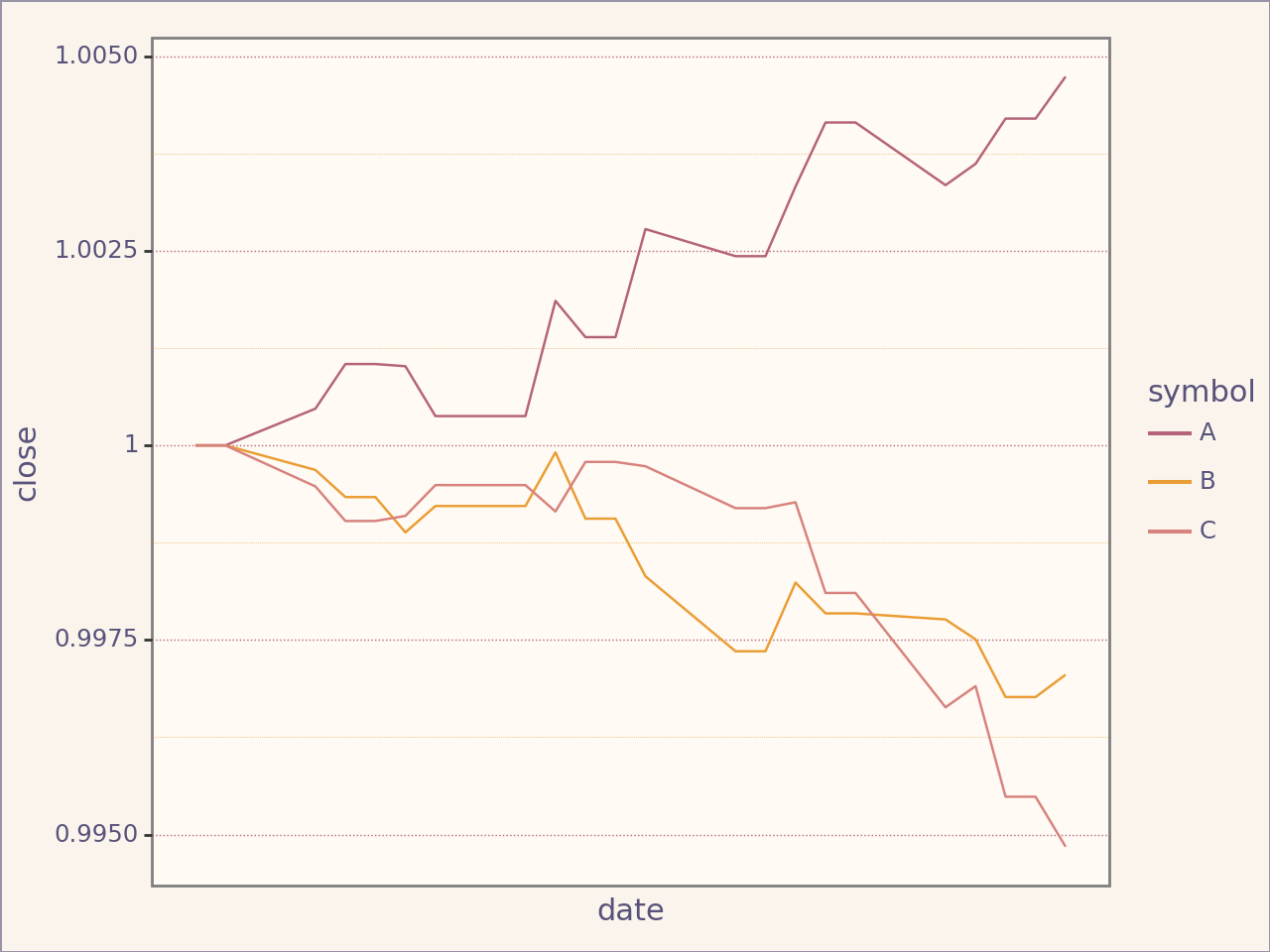

Or the cumulative returns:

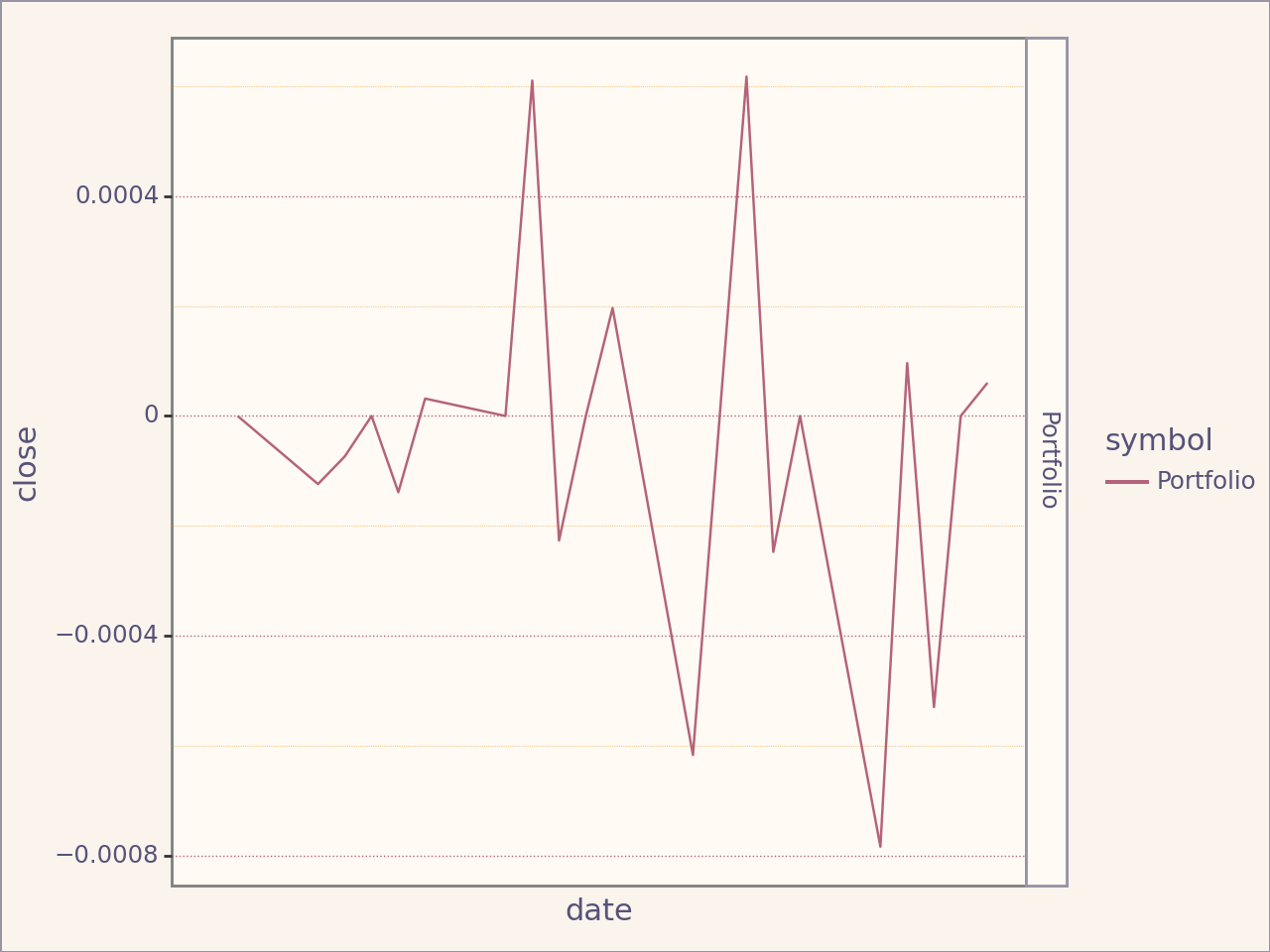

Portfolio Returns#

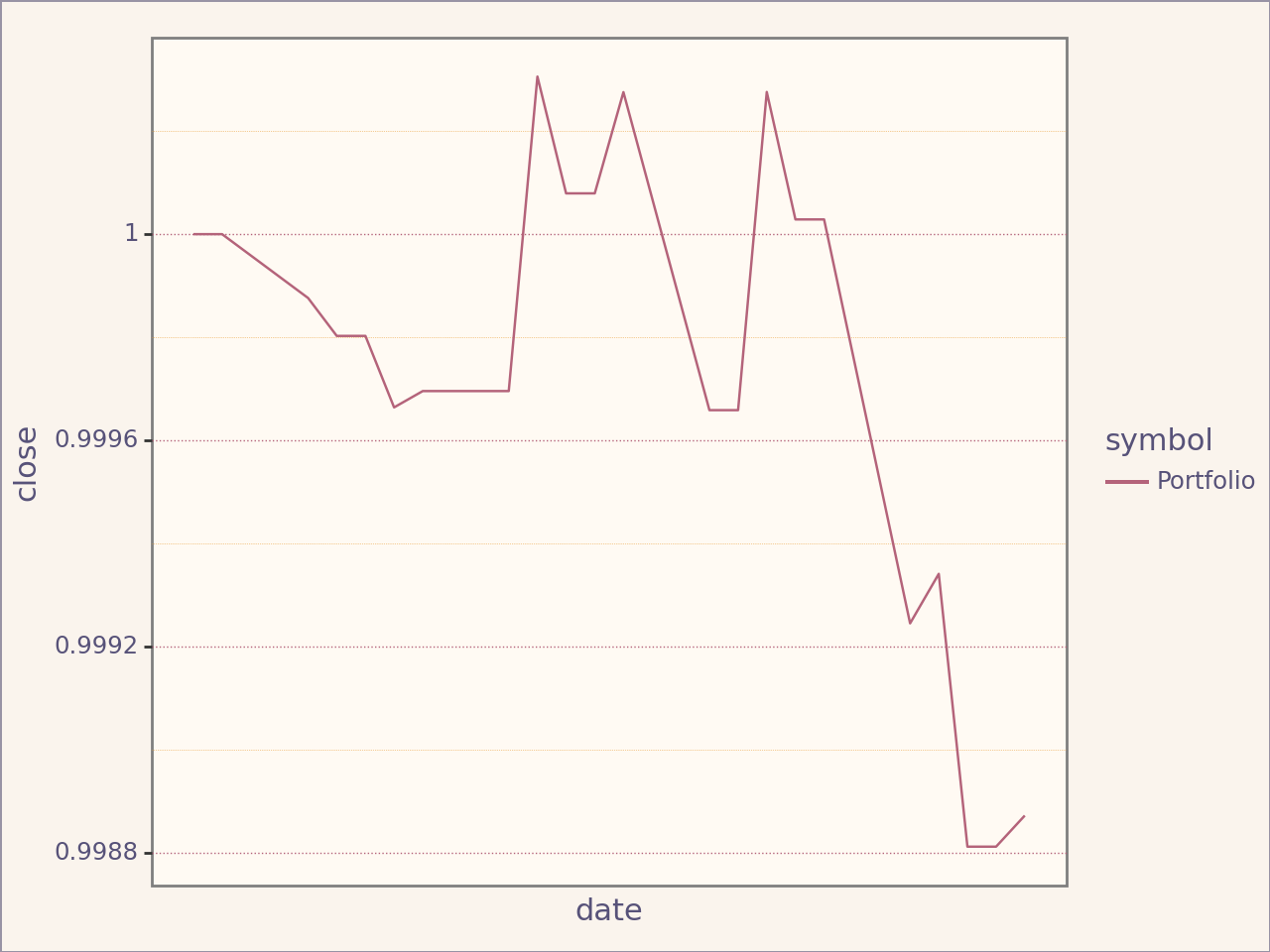

portfolio_returns1 = plan1.portfolio_returns()

portfolio_returns1.plot_close()

Cumulative Portfolio Returns:

Combining plans#

You might be interested in the joined returns of two investment plan happening at different timeframe.

plan2 = Plan(

portfolio = portfolio,

start_date = datetime.strptime("2025-03-02", "%Y-%m-%d"),

end_date = datetime.strptime("2025-05-05", "%Y-%m-%d")

)

print(plan1)

print(plan2)

------------------------------------------------------------

| Plan for period 2025-01-30 00:00:00, 2025-03-01 00:00:00 |

------------------------------------------------------------

| A |

------------------------------------------------------------

| B |

------------------------------------------------------------

| C |

------------------------------------------------------------

------------------------------------------------------------

| Plan for period 2025-03-02 00:00:00, 2025-05-05 00:00:00 |

------------------------------------------------------------

| A |

------------------------------------------------------------

| B |

------------------------------------------------------------

| C |

------------------------------------------------------------

portfolio_returns2 = plan2.portfolio_returns()

cumulative_portfolio_returns2 = portfolio_returns2.cumulative("Cumulative")

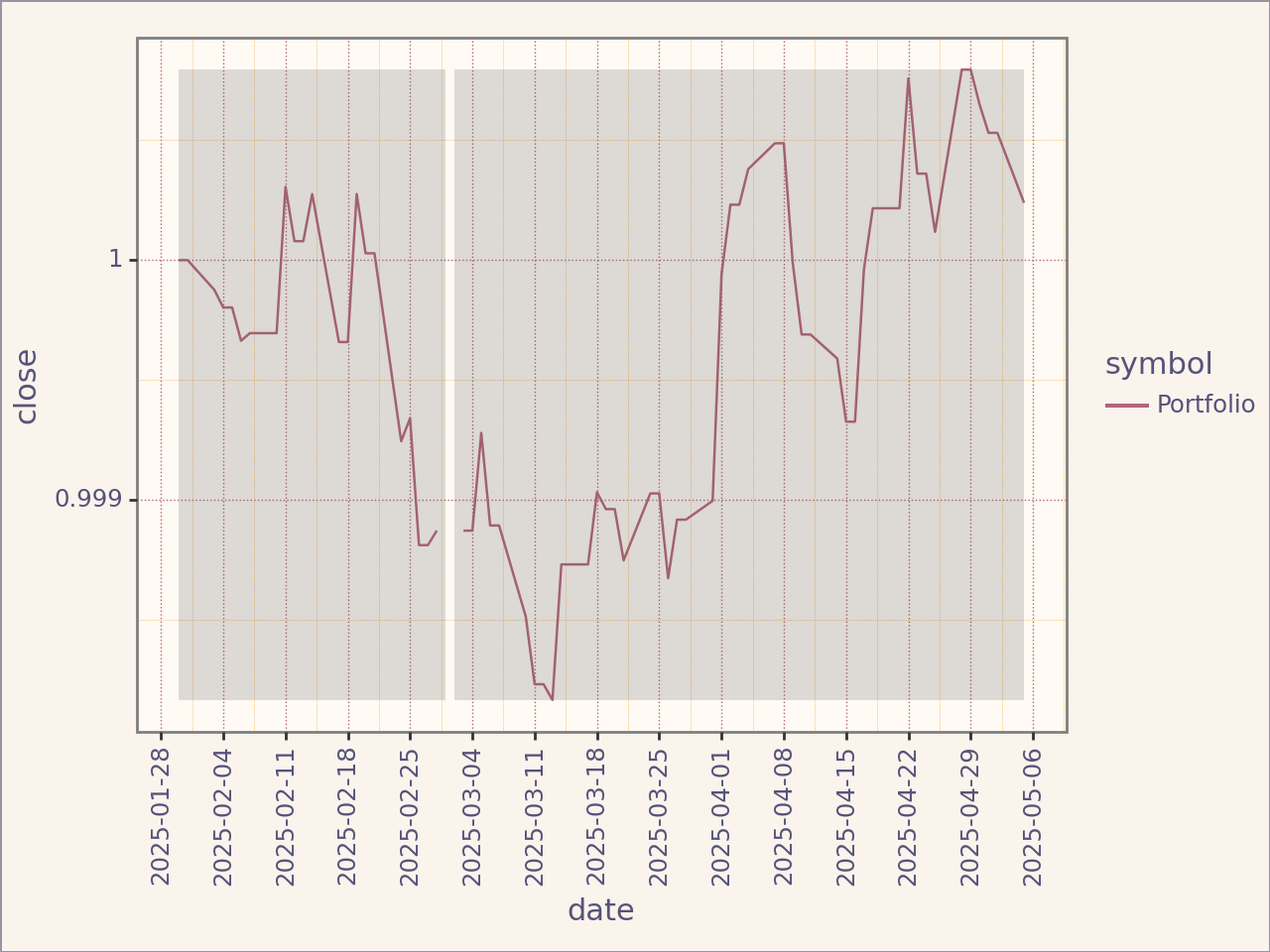

The >> operator enables easy creation of joined plan.

joinedplan = plan1 >> plan2

joinedplan

┌────────────┐

│ JoinedPlan │

└──────┬─────┘

│

┌─────────────────────────────────┴─────────────────────────────────┐

┌───────────────────────────────┴──────────────────────────────┐ ┌───────────────────────────────┴──────────────────────────────┐

│ ------------------------------------------------------------ │ │ ------------------------------------------------------------ │

│ | Plan for period 2025-01-30 00:00:00, 2025-03-01 00:00:00 | │ │ | Plan for period 2025-03-02 00:00:00, 2025-05-05 00:00:00 | │

│ ------------------------------------------------------------ │ │ ------------------------------------------------------------ │

Note: Plans have to be placed by order of timeframe, otherwise an error will be raised.

from portfolio_plan.errors import PeriodOverlapError

try:

plan2 >> plan1

except PeriodOverlapError as e:

print(e)

Plans can not overlap in time period and must be ordered by time period

Interested in what is the return on investment of a joined plan ?

joinedplan_cumulative_returns = joinedplan.portfolio_cumulative_returns("Joined Plan")

joinedplan_cumulative_returns.data

| CumulativeReturns | open | close | high | low | |

|---|---|---|---|---|---|

| symbol | date | ||||

| Portfolio | 2025-01-30 | 1.000000 | 1.000000 | 1.000000 | 1.000000 |

| 2025-01-31 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | |

| 2025-02-03 | 0.999746 | 0.999876 | 0.999939 | 0.999918 | |

| 2025-02-04 | 0.999591 | 0.999803 | 0.999903 | 0.999870 | |

| 2025-02-05 | 0.999591 | 0.999803 | 0.999903 | 0.999870 | |

| ... | ... | ... | ... | ... | |

| 2025-04-29 | 1.001401 | 1.000794 | 1.000421 | 1.000551 | |

| 2025-04-30 | 1.001095 | 1.000649 | 1.000350 | 1.000456 | |

| 2025-05-01 | 1.000904 | 1.000531 | 1.000286 | 1.000372 | |

| 2025-05-02 | 1.000904 | 1.000531 | 1.000286 | 1.000372 | |

| 2025-05-05 | 1.000310 | 1.000239 | 1.000141 | 1.000179 |

68 rows × 4 columns

joinedplan_cumulative_returns.data.loc["Portfolio"].head()

| CumulativeReturns | open | close | high | low |

|---|---|---|---|---|

| date | ||||

| 2025-01-30 | 1.000000 | 1.000000 | 1.000000 | 1.000000 |

| 2025-01-31 | 1.000000 | 1.000000 | 1.000000 | 1.000000 |

| 2025-02-03 | 0.999746 | 0.999876 | 0.999939 | 0.999918 |

| 2025-02-04 | 0.999591 | 0.999803 | 0.999903 | 0.999870 |

| 2025-02-05 | 0.999591 | 0.999803 | 0.999903 | 0.999870 |

Comparing FinancialSeries#

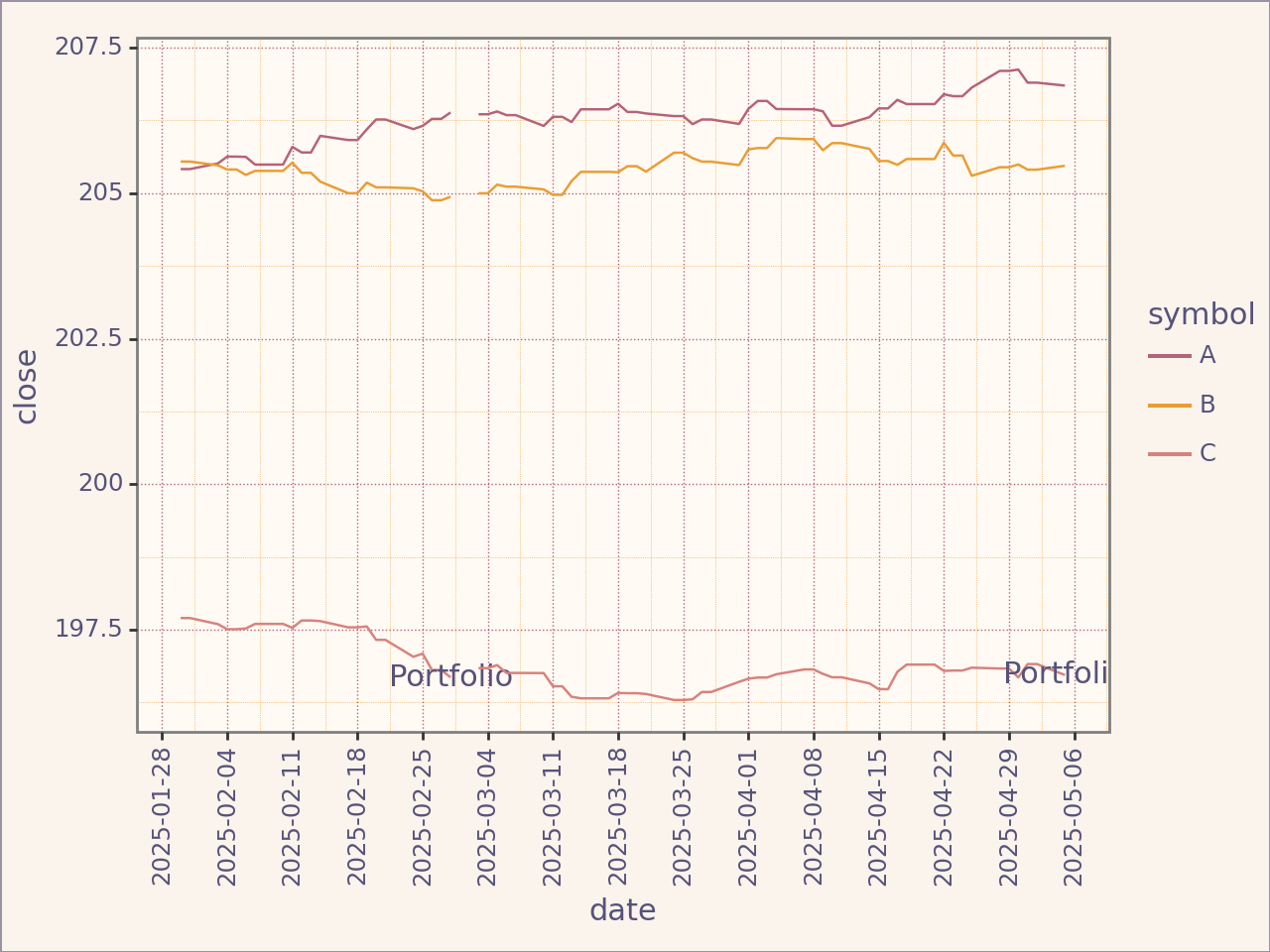

You might want to compare each returns, prices

Prices#

from portfolio_plan.financialseries import Comparison

comparison = Comparison(

[plan1.prices(), plan2.prices()]

)

(

comparison.plot_close(scale_x=False)

+ scale_x_datetime(date_breaks="1 week", date_labels="%Y-%m-%d")

)

/home/runner/work/portfolio-plan/portfolio-plan/.venv/lib/python3.10/site-packages/plotnine/layer.py:364: PlotnineWarning: geom_text : Removed 65 rows containing missing values.

/home/runner/work/portfolio-plan/portfolio-plan/.venv/lib/python3.10/site-packages/plotnine/layer.py:364: PlotnineWarning: geom_text : Removed 137 rows containing missing values.

<Figure Size: (640 x 480)>

Returns#

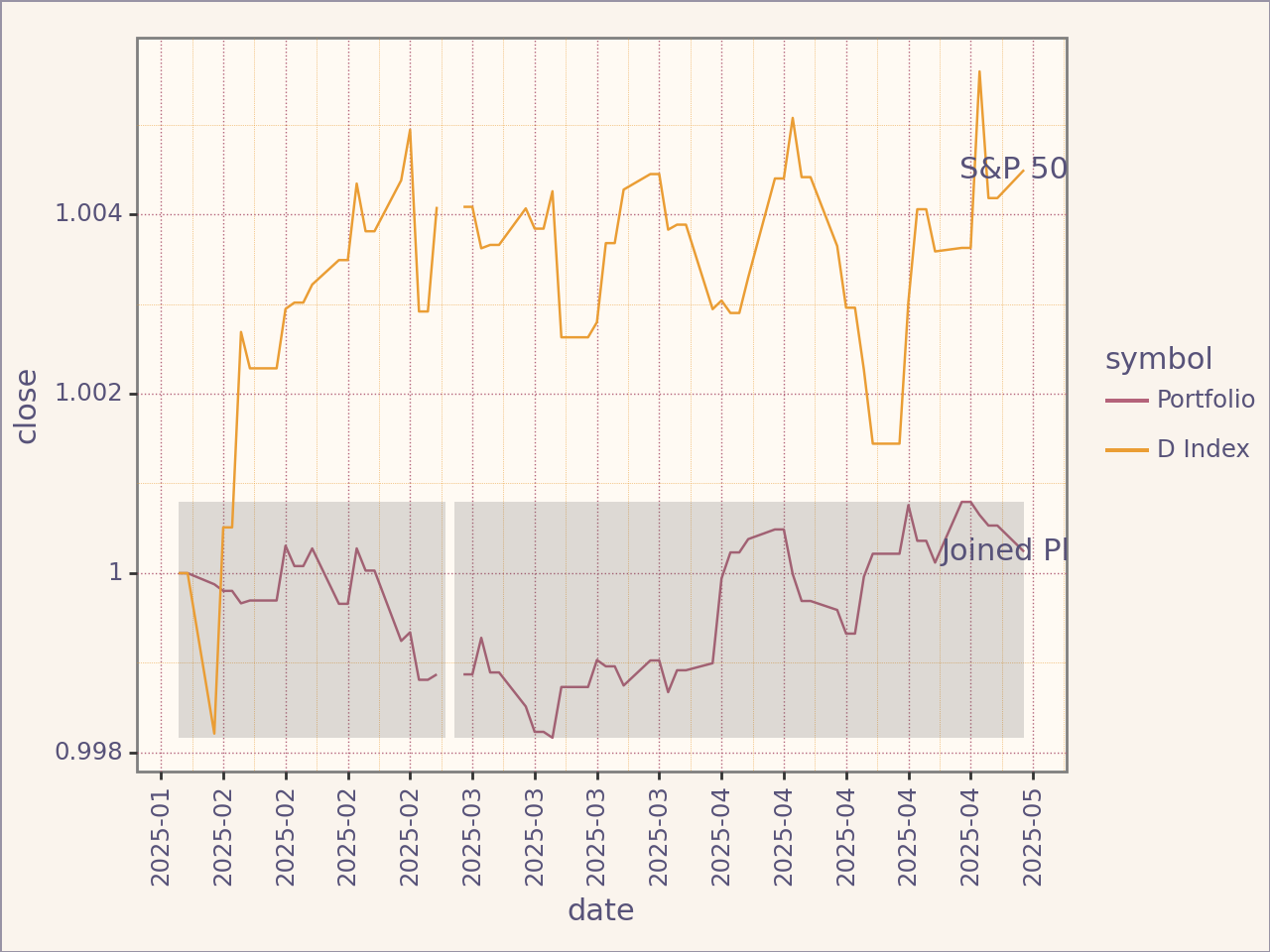

Instead of comparing prices, you want to compare returns. You may want to look at how your strategy differs with an index fund for example

Non-Cumulative#

# NOT YET IMPLEMENTED

Cumulative#

We start by defining the benchmark plan (note that this is only necessary for multiple period investments).

from portfolio_plan.financialseries import Comparison

assets = Assets(

[Asset("^D")],

resource=File(path=example_prices_path(), frequency=Frequency.BDAILY),

)

benchmark = Portfolio(

assets=assets,

weights=Weights(),

name="D Index"

)

benchmark_plan_1 = Plan(

portfolio=benchmark,

start_date=datetime.strptime("2025-01-30", "%Y-%m-%d"),

end_date=datetime.strptime("2025-03-01", "%Y-%m-%d"),

)

benchmark_plan_2 = Plan(

portfolio = benchmark,

start_date = datetime.strptime("2025-03-02", "%Y-%m-%d"),

end_date = datetime.strptime("2025-05-05", "%Y-%m-%d")

)

benchmark_joined = benchmark_plan_1 >> benchmark_plan_2

comparison = Comparison(

[

joinedplan.portfolio_cumulative_returns("Joined Plan"),

benchmark_joined.portfolio_cumulative_returns("S&P 500")

]

)

(

comparison.plot_close(scale_x=False) +

scale_x_datetime(date_breaks="1 week", date_labels="%Y-%m")

)

/home/runner/work/portfolio-plan/portfolio-plan/.venv/lib/python3.10/site-packages/plotnine/layer.py:364: PlotnineWarning: geom_text : Removed 67 rows containing missing values.

/home/runner/work/portfolio-plan/portfolio-plan/.venv/lib/python3.10/site-packages/plotnine/layer.py:364: PlotnineWarning: geom_text : Removed 67 rows containing missing values.

<Figure Size: (640 x 480)>

Information Ratio#

It is possible to calculate the information ratio between two plan. Since each ratio corresponds to a specific investment plan, no annualization is performed. Plans must have the same starting period or ending period.

from portfolio_plan.ratios import InformationRatio

ir = InformationRatio(plan1, benchmark_plan_1)

ir_returns1 = ir.period_returns() # Returns a singleton dataframe

assert ir_returns1.is_singleton

ir_returns1

-----------------------------------------------------------------

| Returns for period 2025-02-28 00:00:00 to 2025-02-28 00:00:00 |

-----------------------------------------------------------------

| IR: Portfolio-D Index |

-----------------------------------------------------------------

ir = InformationRatio(plan2, benchmark_plan_2)

ir_returns2 = ir.period_returns()

assert ir_returns2.is_singleton

ir_returns2

-----------------------------------------------------------------

| Returns for period 2025-05-05 00:00:00 to 2025-05-05 00:00:00 |

-----------------------------------------------------------------

| IR: Portfolio-D Index |

-----------------------------------------------------------------

ir_returns1.data

| open | low | high | close | ||

|---|---|---|---|---|---|

| symbol | date | ||||

| IR: Portfolio-D Index | 2025-02-28 | -0.256186 | -0.252886 | -0.252465 | -0.253722 |

ir_returns1.data

| open | low | high | close | ||

|---|---|---|---|---|---|

| symbol | date | ||||

| IR: Portfolio-D Index | 2025-02-28 | -0.256186 | -0.252886 | -0.252465 | -0.253722 |

Information Ratio Returns are always singletons.